Cott Corp. (COT) should be in crisis-mode: it is overleveraged, underperforming, and lacking both a permanent CEO and a compelling growth strategy. With an activist investor and some seasoned executives on the Board to shake things up, one would expect dramatic action, but it seems like little has been accomplished to date. Have they really been that ineffective, or have they perhaps been distracted? Shareholders need to know what is happening. If there is any material news, we should not have to wait for the next earnings call.

Last year, things began to look encouraging when:

- the company parted ways with its CEO and initiated a search for a successor;

- activist investor Crescendo Partners purchased an 8% stake and installed four new directors; and

- the company embarked on a turnaround plan targeting over $40 million of cash flow improvement (there was still no real growth strategy, but presumably that would come with a CEO).

With accomplished investors and executives on Cott’s board (although only one has beverage experience), one would have expected rapid change. Instead, we have had more of the same:

- revenue and EBITDA still trended downward as of September 27th, as Coke and Pepsi promoted aggressively, Wal-Mart cut-back shelf space, and initial savings from the turnaround plan were offset by other costs;

- net debt was unchanged in September versus June;

- the Interim CEO has discussed the need to invest in growth, but has not outlined a strategy; and

- there is still no permanent CEO.

On the last earnings call on November 6th, the company’s Interim CEO, David Gibbons, said that he expected a decision on a new, permanent CEO by year-end. The end of the year has passed, yet there is no news.

This is frustrating, and begs the question of whether there is something else going on at Cott. Crescendo’s CEO, Eric Rosenfeld, joined Cott’s board as Lead Independent Director, and I doubt that he would sit idle while things drag on. Cott hired a respected search firm to help identify a CEO, and Crescendo also had at least one candidate lined up. It is possible that the board has not been able to agree on a candidate. It is also possible that they had a big fish on the line but that it got away at the last minute. However, it is also possible that the board slowed down the process to deal with something else. This is sheer speculation, but one reason to delay the process, and the only good reason I can think of, would be a potential sale of the company.

This is frustrating, and begs the question of whether there is something else going on at Cott. Crescendo’s CEO, Eric Rosenfeld, joined Cott’s board as Lead Independent Director, and I doubt that he would sit idle while things drag on. Cott hired a respected search firm to help identify a CEO, and Crescendo also had at least one candidate lined up. It is possible that the board has not been able to agree on a candidate. It is also possible that they had a big fish on the line but that it got away at the last minute. However, it is also possible that the board slowed down the process to deal with something else. This is sheer speculation, but one reason to delay the process, and the only good reason I can think of, would be a potential sale of the company.

Has a Potential Buyer Heeded My Call?

Last October, I wrote an article entitled, “Cott Corp. – Could go Far, But Somebody Needs to Grab the Wheel.” The article included this call to action directed at potential buyers: “Now is the time for action by an industry acquirer, or a private equity group with the ability to capitalize Cott properly.” I said that the most likely strategic buyers are National Beverage (FIZZ), Dr Pepper Snapple Group (DPS), and Polar Beverages.

My article seemed to create a stir at Cott and in other beverage circles. The morning that the article was posted on Seeking Alpha, a Cott executive contacted me and asked about my background and affiliations, and how I came to know so much about the company. But he also gave me positive feedback on the article. I later learned from reliable sources that each of Cott’s directors had received the article. I also heard from several industry executives who thought that my article was right on target. I had assumed that the kudos had to do with my emphasis on getting back to basics and hiring an effective CEO, but perhaps there was more to the feedback….

If the Company Were Sold, What Would Be a Fair Price?

Absent an acquisition, my estimate of Cott’s fair value is $1.00-$1.50 per share. I get to this figure by applying discounted market multiples to my estimates of 2008 and 2009 EBITDA. I get to the same figure through a discounted cash flow analysis that factors in a turnaround over the next three years (but shows little top-line growth). This value estimate is higher than price targets from some reputable sell-side analysts. For example, an analyst at a well-known global bank (which also owned over 5% of Cott’s common shares as of the last proxy statement) had a price target of $1.00 per share as of this writing, which was lowered from $1.25 per share in November (he also used EBITDA multiples and a DCF analysis). In calculating my fair value estimate, I discount my EBITDA multiples, and add a risk premium to my DCF discount rate[1], because of two significant risks the company faces: high leverage and customer concentration. Absent these risks, my valuation would be in the range of $2.00-$2.50 per share.

A strategic acquirer that could realize synergies might value the company in the range of about $2.50 to $3.50 per share. I have done enough fairness opinions in my career to feel comfortable that Cott’s board would be advised that such a price was fair. The chart below shows the implied enterprise value and EBITDA multiples for various share prices.

The above fair value estimates and estimates of an acquisition price would all be much higher if Cott had better growth prospects.

The Board is Unlikely to Accept an Offer Today

While $2.50 to $3.50 per share may be a fair value, it is unlikely that Cott’s board members would agree.

Following its purchase of 5.9 million Cott common shares last year, Crescendo Partners had four new directors named to what is now an 11-person board. These new directors and at least three others have a strong incentive to block a change of control.[2] Thus, a firm that owns only 8% of the company’s common shares is effectively in a position to block Board approval of any transaction it does not like.

Crescendo purchased its shares at an average price of $2.84 per share (see 13D filing). It is clear in hindsight that things at Cott were worse than they appeared last spring when these purchases were made, and that Crescendo overpaid. While Crescendo might be happy just to get its investment back, it is much more likely that they would want to put in a new CEO and let that person attempt to build value for a few years before selling.

A Long and Bumpy Road Ahead

If an investor or competitor does not (or cannot) “grab the wheel” by purchasing Cott, and shareholders have to rely on a new CEO to navigate the company out of its current situation, we should be prepared for a difficult journey. The problems faced by the company are not easily fixed. Yes, retailers should now have a greater interest in building their private label programs, but Cott’s area of expertise – carbonated soft drinks – is going to be a tough place to find growth. Cott knows this and is expanding into other areas, such as water and noncarbonated drinks, but these are markets in which Cott has numerous competitors with ample capabilities.

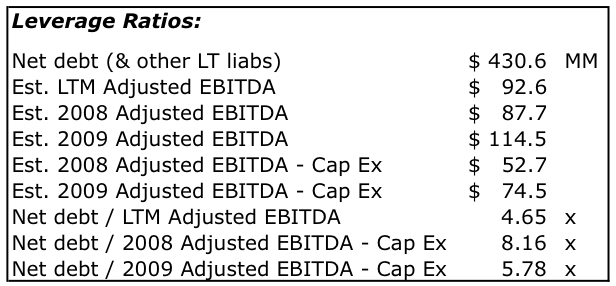

Cott’s high leverage means that it cannot afford to make a mistake. The chart to the right shows Cott’s net debt as of September 27th, and how this compares to various measures of cash flow.

Cott’s high leverage means that it cannot afford to make a mistake. The chart to the right shows Cott’s net debt as of September 27th, and how this compares to various measures of cash flow.

Given the difficulty of executing a turnaround, I would not expect lenders to have patience in the event of a default. If things go South, I believe there will be little left for common shareholders. A savvy investor would be able to purchase Cott’s 8% Senior Subordinated Notes for pennies on the dollar in that scenario and end up owning the company through a Chapter 11 reorganization.

Even if management executes well, it will take a long time to deleverage the business. Subtracting interest and capital expenditures from EBITDA leaves only about $20-$30 million per year to pay down debt. If management decides to try to grow its way to success instead of cutting costs to the bone – which is probably the best strategy for the long term – there will be even less cash flow available to repay debt until the growth starts to generate profits.

A risk that may never go away is the company’s dependence on Wal-Mart (WMT). Wal-Mart represents 36% of Cott’s sales, and I believe it has been Cott’s cash cow. I can say from experience as a private equity investor who has looked at thousands of companies, that when a customer represents nearly 40% of sales it often represents well over 50% of profits (sometimes over 100%), even if that customer is known for driving a hard bargain. The substantial benefits of long and efficient production runs, along with freight efficiencies, typically more than offset lower unit prices.

I warned in my last article that Cott’s customers might be concerned about the company’s viability. The customer I had in mind was Wal-Mart. Wal-Mart’s reduction of Cott’s shelf space last year may have been the first step toward reducing its exposure to Cott. The next logical step would be to split the business, or maybe even go all the way and switch suppliers (an extreme event that I would like to think is improbable). Analysts have asked Cott about its relationship with Wal-Mart on recent earnings calls, and management has responded with assurance that the relationship is fine. I do not have reason to doubt management’s statements, but I remain concerned about this risk.

Given Wal-Mart’s share of U.S. beverage sales, Cott should not address this risk by reducing the percentage of its sales that go to Wal-Mart. The better approach is to do what it takes to make sure that Wal-Mart is satisfied – not just with the terms of its relationship but also with Cott’s viability and stability as a long-term partner. In a normal capital markets environment, I would recommend an equity infusion to fund growth and reduce debt. In the current environment, meaningful deleveraging and growth capital would almost certainly require a change of control.

Time for Action

Cott is vulnerable, and one should not assume that customers and competitors are sitting still. The Interim CEO seems capable but has no beverage experience. This is no time for the company to drag its feet, and no time to keep shareholders in the dark. Cott’s board should let us know what is going on, and, more importantly, DO something!

The company should also ensure that its board is structured to encourage decisions that are fair. Putting an 8% shareholder in a position to call the shots on a change of control transaction does not strike me as consistent with board members’ fiduciary obligation to look out for all shareholders. If Cott is ever presented with the opportunity to enter into discussions with a potential buyer, the board should form a special committee, made up of truly independent directors, to make key decisions. And shareholders should be informed.

Financial Summary

A summary of the company’s historical financial performance and my projections for 2008 and 2009 follows below. As previously discussed, I assume that it takes several years to achieve management’s turnaround objectives. I assume that revenue growth is flat in 2009 (i.e., that price increases equally offset volume reductions), and that gross margin improvements from prices increases are offset next year by unfavorable variances from a stronger dollar. I include $20 million of cost savings from the water project, but assume that G&A savings are offset by investments to maintain, and eventually grow, the business – mainly “market development funds.”

Footnotes:

[1] This may offend CAPM purists, but it is a lot easier than calculating an unlevered beta.

[2] Cott Corp.’s Board of Directors is comprised of Chairman David Gibbons, George Burnett, Stephen Halperin, Betty Jane Hess, Philip Livingston, Andrew Prozes, Graham Savage, and four new directors appointed in connection with Cott’s agreement with Crescendo: Eric Rosenfeld, Mark Benadiba, Mario Pilozzi, and Greg Monahan. Their bios are on Cott’s website. Other than the Crescendo parties (Rosenfeld and Monahan), those with the least incentive to approve a change of control would appear to be:

- David Gibbons. He makes $725,000 per year plus incentive awards as Cott’s Interim CEO, and approximately $100,000 more per year as a director. He would lose this income upon a change of control.

- Stephen Halperin. He is the brother of the company’s former chief legal counsel, Mark Halperin, and has been on the board since 1992. Cott’s most recent Proxy Statement discloses that his firm provides services to Cott “on a regular basis,” which services would likely be discontinued after a change of control.

- Philip Livingston. He earns over $100,000 per year as a Cott director. His role on Cott’s Audit Committee is featured prominently on his personal website.

- Mario Pilozzi. He was likely brought on because his former role as CEO of Wal-Mart Canada may leave him with important ties to Wal-Mart. These same ties would create a bias toward Cott remaining an independent company, which would benefit Wal-Mart.

- Mark Benadiba. Mark probably would like to be CEO of Cott himself. As long as this remains a possibility, he will have a bias against a transaction that would take that possibility away.

(Disclosure: The author is long COT common stock)

| Copyright © 2008-2009 by John G. Appel. All rights reserved. You may link to any Content on this website. You may not republish, upload, post, transmit or distribute any Content without prior written permission. If you are interested in reprinting, republishing or distributing Content, please contact John Appel via the e-mail address shown on this website to obtain written consent. Modification of Content or use of Content for any purpose other than your own personal, noncommercial use is a violation of our copyright and other proprietary rights, and can subject you to legal liability. Disclaimer: This website is provided for informational purposes only. Nothing on this website is intended to provide personally tailored advice concerning the nature, potential, value or suitability of any particular security, portfolio or securities, transaction, investment strategy or other matter. You are solely responsible for any investment decisions that you make. Terms of Use: By using the site, you agree to abide by the Terms of Use, which includes further copyright information and disclaimers. |

This is CIC Advantage’s second investment to date. The first was a $12 million growth capital investment in

This is CIC Advantage’s second investment to date. The first was a $12 million growth capital investment in