Catastrophes both natural and man-made have been hitting reinsurance companies, but the outlook is good. Shares of all the reinsurance companies were pummeled in October, with the combination of Hurricanes Ike and Gustav hitting underwriting profits while the capital markets carved a mark-to-market chunk out of investment portfolios. Things seemed to improve around Halloween and into November, as signs of “hardening” premium rates began to emerge. But shares have recently retested their lows as the dysfunctional capital markets – especially for mortgage- and asset-backed securities – overshadow improving fundamentals for the group. This has created opportunity for the intrepid value investor.

|

| * Does not include AIG, BRK, and XL. |

|

I evaluated a dozen reinsurers based on factors including:

- underwriting and overall profitability;

- historical and expected premium growth;

- financial strength ratings;

- fixed income portfolio make-up, duration and average ratings;

- financial leverage; and

- capital adequacy.

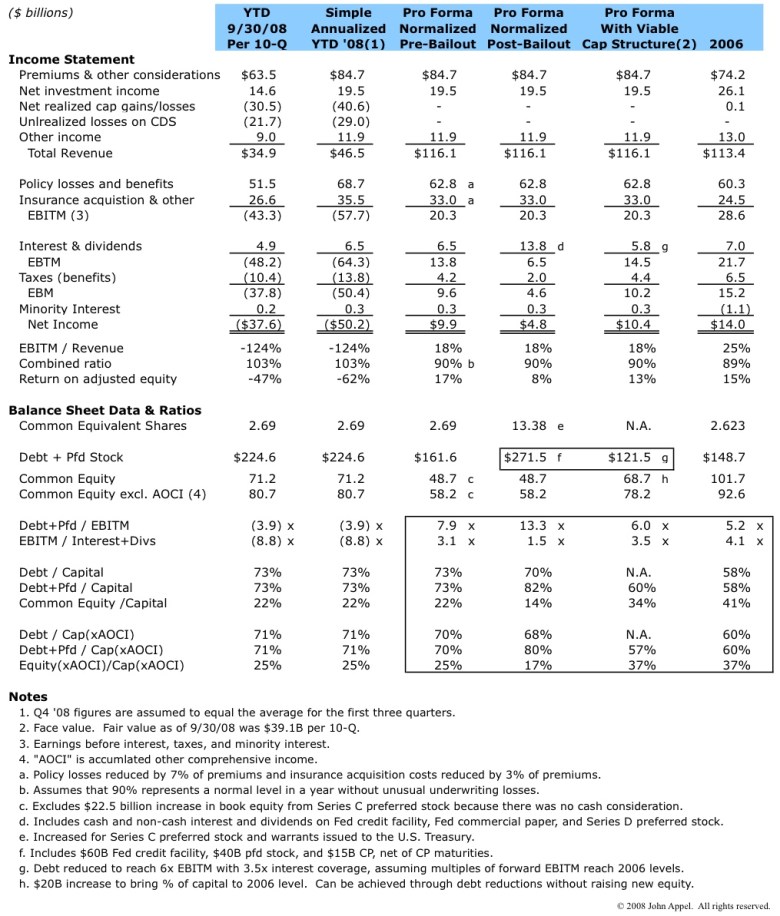

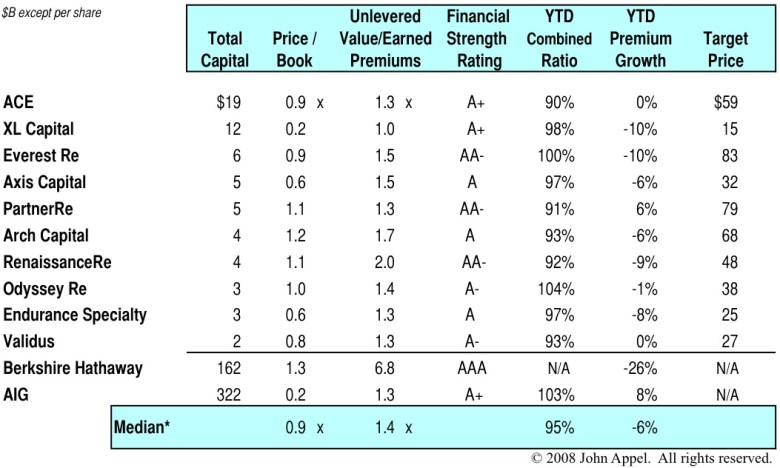

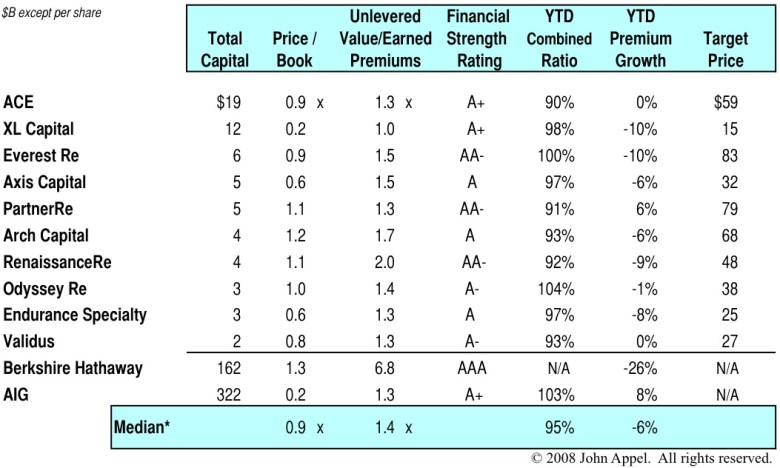

Table 1 lists these companies in order of total capital, along with relevant market value multiples, some key performance metrics, and my per-share valuation of each company based on fundamental analysis (except for AIG (AIG) and Berkshire Hathaway (BRK-A), which I include for comparison but don’t value). Table 2 provides information on their investment portfolio quality. Table 3 shows debt-to-capital ratios and a ratio I use a rough indication of capital adequacy: the ratio of cash and investments to loss reserves.

Table 1 – Reinsurer Market Multiples, Key Metrics & Target Price

|

| * Medians exclude Berkshire Hathaway and AIG. See endnotes for an explanation of terms and calculations. |

|

The companies that trade (as of 11/24/08) at the steepest discount to my estimated “fundamental” values are ACE Limited (ACE), Axis Capital (AXS), PartnerRe (PRE), Validus (VR), and XL Capital (XL). Below is a brief discussion of each company:

Table 2 – Fixed Income Portfolio Quality

|

| * Medians exclude Berkshire Hathaway and AIG. See endnotes for an explanation of terms and calculations. |

|

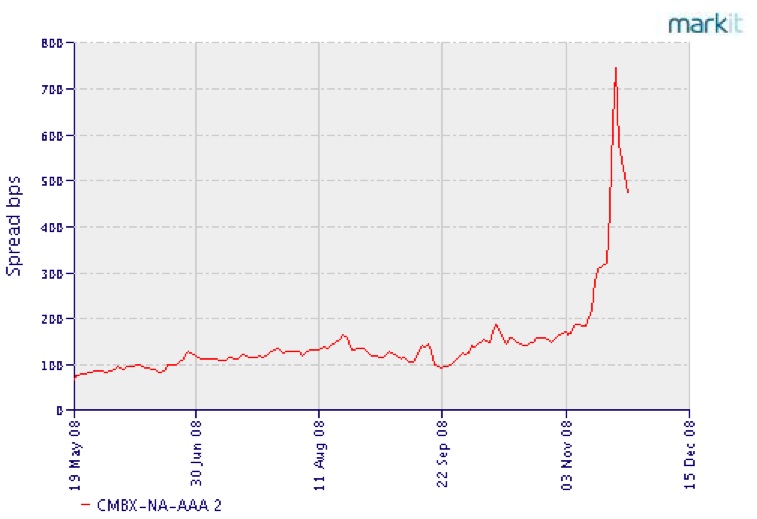

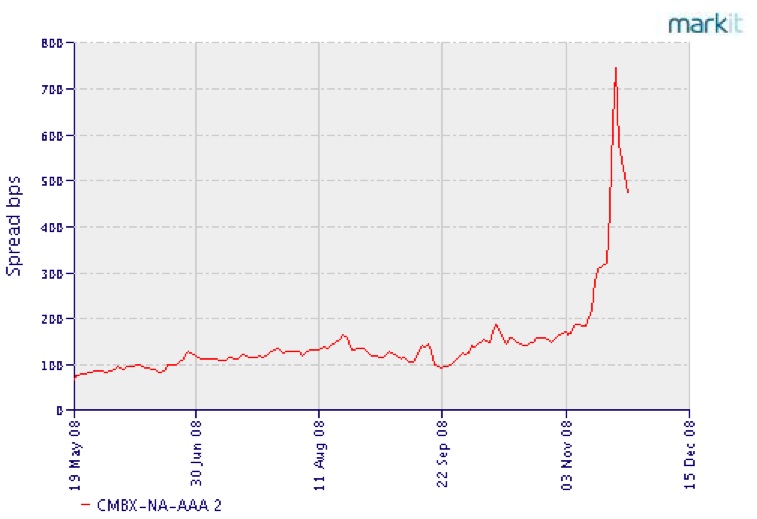

- ACE Limited, founded in 1985, is a Zurich-based leading global property & casualty, life, and accident & health insurance company and reinsurance company with operations in more than 50 countries. Its ACE Tempest reinsurance operations are well respected but comprise less than 10% of ACE’s consolidated net written premiums. Reinsurance net written premiums are down over 22% YTD, but its prospects for growth are good, as ACE has the scale and reputation to capture significant business from AIG at January renewals. ACE has the best YTD combined ratio of the group. The quality of its fixed income portfolio is about average for the group, and its make-up and duration are consistent with its insurance business mix. As of 9/30, ACE had $5.5 billion of asset-backed securities (“ABS“) and non-agency mortgage-backed securities (“MBS“) in its portfolio, including $2.3 billion of commercial mortgage-backed securities (“CMBS“). Given that spreads have recently skyrocketed for these securities (see chart, below), ACE is likely to report more unrealized investment losses in the fourth quarter (a 100 basis point yield increase equates to a +/-350 bp price reduction on a portfolio with a 3.8 year duration, or over $1 billion on ACE’s $36 billion fixed income portfolio). These unrealized losses should have little real impact because ACE should not need to sell its structured securities (at least not in this market), but it seems that investors need little incentive to punish a stock these days, so value investors should see further buying opportunities.

CMBS Spreads

|

| click image to enlarge |

|

- Axis Capital is a Bermuda-based specialty P&C insurer and reinsurer, founded in November 2001. Reinsurance is the majority of its business. Property, professional lines and catastrophe are its largest business lines, representing 26%, 21% and 16% of gross premiums written. These businesses should all see firming rates in 2009. Its fixed income portfolio is higher rated on average than most at AA+ and the average duration is shorter than most at 2.9 years. It includes $1.7 billion of ABS and non-agency MBS (including $860MM CMBS). The relatively short portfolio duration means that an increase in credit spreads not only will have less effect, but also is more likely to be offset by yield curve changes. One potential portfolio risk is the $636 million of hedge funds, credit funds and CLO equity tranches, for which marks vs. cost are not disclosed. However this exposure is only 13% of book value. AXS is very well capitalized relative to its current book of business, and its debt-to-capital is the lowest of the group at only 9%, so the company is quite well positioned to grow. S&P gives it an “A” rating but a “positive” outlook – the only “positive” for the group. Its management team is strong and seasoned, and its level of capitalization and other metrics are more representative of an A+ company, so it is likely that its relatively short operating history has been the only thing holding it back from an A+.

- PartnerRe, based in Bermuda, was founded in 1993 and is the 10th largest global reinsurer, with lines of business that are well diversified by risk category and geography. Premium growth YTD was driven by opportunistic business in the agriculture sector; other lines of business declined consistent with the group (when adjusted for one-time items). A principal reason for the decline was greater risk retention by ceding insurers. With insurer balance sheets constrained and little ability to reload in the current capital markets environment, risk retention by primary insurers is less likely to impact growth in the next year or two. The company is well positioned with its “AA-” S&P rating. PRE’s combined ratio was an attractive 91.4% despite hurricane losses in Q3, which speaks to the company’s underwriting discipline and ability to generate profitable growth. PRE’s investment portfolio has only $825MM of ABS and non-agency MBS, although widening credit spreads on its $1.3 billion of finance sector corporate bonds (banks – $600MM) will also have an impact. Unrealized losses will hit earnings, not just comprehensive income, because PRE elected “fair value” treatment under FAS 159 this year (ACE, AXS, VR and XL continue to flow unrealized losses through comprehensive income, except that ACE made the FAS 159 election for its equity securities).

- Validus Holdings, based in Bermuda, was formed in December 2005. Through Validus Re, it is a leading writer of property catastrophe insurance and also writes marine, energy and other specialty, short-tail lines. VR writes direct insurance through Lloyds syndicate member Talbot, which it acquired last year. VR was initially capitalized by private equity groups Aquiline Capital, Vestar Capital Partners, New Mountain Capital, and private equity affiliates of Goldman Sachs and Merrill Lynch. The company went public in July 2007. VR is very well capitalized for the size of its current business, with cash and investments of 2.7x loss reserves, and debt-to-capital of only 13.7%. Its “A-” rating from A.M. Best is typical for the Bermuda “Class of 2005” and more indicative of its limited track record than its financial health and operations. Its combined ratio YTD is still 93% even after Ike and Gustav took it up to 122% in Q3. ABS and non-agency MBS of $653MM is 34% of book value but the average rating for the total portfolio is “AAA-” and the duration is a low 2.2, which is consistent with its short-tail focus and should provide some cushion against widening credit spreads. Growth was flat last year (pro forma for Talbot) but VR is very well positioned to grow next year.

Table 3 – Leverage and Capital Adequacy

|

| * Medians exclude Berkshire Hathaway and AIG. See endnotes for an explanation of terms and calculations. |

|

- XL Capital, based in Bermuda and founded in 1986, is a diversified P&C insurance, life insurance and reinsurance company with 77 offices in 27 countries. Its reinsurance businesses are ranked among the 12th largest globally. XL’s situation shows how confidence is much easier lost than regained, and is a good example of how, in today’s environment, investors sell first and ask questions later. XL’s price/book multiple is lower than AIG’s, and from its stock price trajectory, one would think that XL was headed for the same explosive fate, but without a bailout. However, XL’s current operating performance, and even the rating agencies that give XL a “negative” outlook, paint a much more positive picture. The rating agencies say XL has “strong” capital adequacy. XL’s debt-to-capital ratios in Table 3 do not reflect that $745MM of debt converts to equity on 2/11/09. On a pro forma basis, debt/capital and debt+pfd/capital are a very reasonable at 17% and 27% respectively. Its fixed income portfolio has an average rating of “AA,” on par with the group, and an average duration of 4.1 years, the same as PRE and lower than Everest Re and Odyssey Re. XL’s ABS and non-agency MBS is slightly higher than the group as a percentage of book equity, at 77%, but lower than RenaissanceRe (RNR) and Endurance (ENH) as a percentage of total cash and investments. Its CMBS portfolio is now at $2.4 billion, after $800MM was sold in Q3, bringing it close to ACE’s $2.3 billion level. Its 10% decline in premiums written this year is about the same as for Everest and RenaissanceRe, and less than Berkshire’s 25% decline or ACE’s 22% drop in reinsurance premiums. Besides, sacrificing growth for pricing discipline is a virtue. Its combined ratio of 97.7% YTD is better than Everest (RE), Odyssey (ORH), Endurance and AIG, and about the same as AXS. None of this explains the 85%+ drop in XL’s share price this year. There must be more to the story….

A Closer Look at XL

1. Guilt by Association with Credit Default Swaps

Most of XL’s problems stem from the financial guaranty company, Syncora (SCA). Formerly known as Security Capital Assurance, Syncora was a subsidiary of XL Capital until XL brought its ownership below 50% through secondary market sales following Syncora’s 2006 IPO. Last year and earlier this year, XL Capital had a real mess on its hands because Syncora was facing serious issues with credit default swaps – very much like AIG – and XL Capital was on the hook for some of the risk.

In addition to the Syncora issues, XL had it’s own challenges, including the integration of several acquired businesses, strengthening its enterprise risk management systems, and de-risking an investment portfolio that had become too heavily laden with mortgage-backed securities.

In March of this year, XL announced that it was bringing in a new CEO, Mike McGavick, to turn things around. Mike had a great track record of success at CNA and at Safeco, which he substantially turned around in less than a year. A number of his moves at XL look like they come straight from his Safeco playbook: move quickly and get the financial pain out of the way; look to pay down debt through asset sales; invest in systems in order to wring efficiencies out of poorly-integrated acquired businesses, and ruthlessly drive down costs wherever possible.

CDS = “Collateralized Death Spiral”

|

|

Mike’s most immediate challenge was Syncora. As the credit quality of the debt underlying Syncora’s credit default swaps eroded, it faced the same death spiral – ratings cuts, collateral calls, security sales, capital drain, ratings cuts, collateral calls… – that hobbled AIG. XL was only a minority owner of Syncora, but as of 6/30/08 still had exposure through guarantees and reinsurance to a whopping $65.7 billion net par value of pre-IPO contracts.

Even though XL’s actual exposure under these contracts was estimated to be only $1.0-$1.5 billion, write-downs related to Syncora were damaging its financial statements – and its reputation. In July, Chubb was reported to have taken XL off of its approved list of markets for facultative reinsurance. S&P, Moody’s and Fitch all gave XL a negative outlook, citing its Syncora exposure.

XL needed to get out from under the Syncora cloud fast (and Syncora needed cash), so on August 5th, XL paid $1.8 billion plus 8 million common shares to erase over 98% of this risk through a settlement agreement with Syncora and certain of its counterparties (XL also transferred its remaining Syncora shares to a trust for Syncora CDS counterparties). This payment was funded with part of the $2.9 billion in new preferred stock and equity units issued this year, so the company’s cash balance was still improved versus the beginning of the year.

XL has put its Syncora exposure behind it, but it has been much harder for the company to undo the damage to its reputation. It didn’t help XL that at the same time that it announced the earnings hit for the Syncora settlement, it reported over $1 billion in mark-to-market losses on its fixed income portfolio. Most of the losses were non-cash – approximately $825MM was unrealized losses due primarily to increasing credit spreads. However, the combination of these charges was enough to trigger rumors that the company was on the brink of insolvency. These rumors prompted management to host its earnings call before its third quarter numbers were finalized, and to release detailed data on its portfolio. So far, investors seem unconvinced. What XL needs is more third party validation.

A.M. Best upgraded its outlook from negative to stable following the Syncora settlement, and said that with McGavick at the helm, Syncora behind it, and its latest round of new capital, the company now has the resources befitting a strong insurance franchise. However, S&P, Fitch and Moody’s still have a negative outlook. Chubb has not, as far as I can tell, put XL back on its preferred insurer list.

S&P and the rest actually say some very positive things about XL, but until they change their official outlook, it is likely that investors will focus more on the negative headline than the positive story. In maintaining its negative outlook, S&P cites “a track record of inconsistent earnings performance; material, though reduced, exposure to large catastrophic losses; susceptibility to further declines in the investment portfolio; and business-integration challenges borne from the relatively rapid building of a very strong and diversified global competitive position.” However, S&P also makes a number of positive comments:

Pro forma Sept. 30, 2008, capital adequacy is strong and incorporates both the market valuation of XL’s investment portfolio and expected Hurricane Ike and Gustav losses that, though material, were within our expectations. …

We expect XL to produce a strong, steady earnings stream from its ongoing core operations at a level equal to that of similarly rated peers, despite soft market pressures. An accident-year and calendar-year combined ratio of less than 100% and a pretax return on revenue (excluding realized gains or losses) of 15% will result from continued pricing discipline and operating performance, absent an unusually severe catastrophe year. Furthermore, financial leverage (debt plus preferreds including hybrids) will be no more than 40% of total capital when reflecting the February 2009 conversion of $745 million of senior notes into equity, and fixed-charge coverage (excluding noncash and unusual charges) will approach 5.5x in 2008 and 2009.

It seems clear that S&P’s reluctance to lift its “negative” outlook is based more on XL’s history than its present status, and that barring any significant missteps, the outlook will be upgraded. However, it could take some time. S&P implies that it will need to monitor results for the next “couple of years” before changing its outlook.

2. Investment Portfolio and Business Risks – Real but Declining and Manageable

Since the Syncora settlement did little to help XL’s stock price, I dug deeper into the two other logical issues: the investment portfolio and the risk portfolio. S&P and A.M. Best both mention XL’s investment performance, and it is clear from my conversations with people in the industry that there are still concerns about what may be lurking in XL’s portfolio.

I looked at XL’s Q3 credit supplement, which provides a substantial amount of detail on the portfolio, including marks versus par and amortized cost. I put together a summary of the data, which shows that fair values seem reasonable, especially when considering the true likelihood of nonpayment rather than temporary swings in treasury rates and credit spreads. XL has $1.3 billion of subprime, Alt-A and second lien loans; however, even the AAA-rated portion of this ($800MM) is carried at 75% of par. The A-rated portion ($300MM) is carried at only 41% of par. The combination of actual credit impairments and today’s insane credit spreads justifies these marks, but it is hard to imagine that 25% and 59%, respectively, of these loans actually will not be repaid. Its $758MM of non-ABS CDOs are carried at 64% of par. Its CMBS are marked at 88% of par, even though default rates for commercial mortgage-backed securities historically have averaged less than 1%. The only mark I question is carrying its $1.4 billion of consumer ABS at 99% of par. XL management has acknowledged the concerns about its portfolio and has already reduced its levels of riskier debt securities and equities. Overall, the portfolio has its issues, but nothing that would justify XL’s current stock price.

One last thing I considered was XL’s exposure to D&O claims. About 24% of XL’s business is professional liability, and a recent study by Advisen Ltd. ranks XL as the third largest writer of D&O coverage for financial institutions, with an 11% market share. The rest of the top five are AIG (19%), Lloyds (17%), Chub (10%) and Travelers (6%). The study predicts that settlements and defense costs for subprime-related D&O claims will be $27 billion, of which the insured portion will be $5.9 billion. This would put XL’s share at $650 million, or 6.5% of book value. This is material, but, again, not enough to explain the current stock price.

The Power of Rumor Over Reality

I spoke to some of my contacts in the industry to try and get to the bottom of this. They talked about XL having a lot of “those toxic subprime” securities in the portfolio, and XL’s having been involved in the whole credit default swap nightmare – nothing new. The good news was that I also heard that XL was “an important market” for them, and that they had not heard anything negative about XL lately. When I probed for details about XL, it became clear that nobody I spoke to had done any primary research. Their views were driven by industry chatter, which in this case seems to lag, not predict, reality.

The time to make a negative call on XL was in late 2007 and the first half of 2008. By the time the negative buzz reached its peak in October ’08, the vast majority of XL’s problems were already behind it.

XL has raised new capital; virtually eliminated its Syncora problem; made progress in de-risking its investment portfolio (including the $800MM reduction in CMBS mentioned earlier, plus a $500MM reduction in corporate credits and other actions); and hired a new “Chief Enterprise Risk Officer” from Goldman Sachs. While XL is likely to have another significant round of mark-to-market losses in the fourth quarter, this will impact “comprehensive income” not net income.

The market has priced disaster into XL’s shares, but while I see challenges, I do not see any signs of impending doom. Mike McGavick has the skills and experience to lead a successful turnaround and has already made real progress. Meanwhile, premium rates for property, catastrophe and professional lines are already firming and the outlook is very good for XL in 2009. The conversion of its senior notes to equity in February of 2009 may be a catalyst for significant appreciation of the stock, especially if XL fares well during January renewals. Unfortunately for XL, unless credit spreads tighten dramatically by year-end (the Fed is certainly pushing in the right direction), it is likely that Q4 mark-to-market losses will offset, or at least temper, positive Q1 news. One thing that would help would be if following Q4 results, one of the other rating agencies revises its outlook to “stable.”

Notes:

“Total Capital” refers to book equity plus minority interests, liquidation preference of preferred stock, and debt. “Capital” refers to “Total Capital” excluding accumulated other comprehensive income (“AOCI“). “Book” and “Book Value” refer to book common equity excluding AOCI. Prices are closing prices on 11/24/08. “Unlevered Value” is equity market value plus minority interest, preferred stock and debt, less an estimate of excess cash for RNR and VR. Premiums earned are for LTM ended 9/30/08. Company ratings are S&P financial strength ratings, or, if there is no FSR, ratings for the P&C operating companies. Validus rating is from A.M. Best. Portfolio average ratings are S&P except Everest, which is Moody’s. Figures for ORH are pro forma for an additional $150MM of share repurchases at an assumed $45/share average price. For AIG, figures: (1) are pro forma for the issuance of $40B Series D Pfd Stock and associated debt repayments, (2) do not include non-cash addition to APIC recorded with Series C Pfd Stock, (3) reflect preferred stock on an as-converted basis, and (4) include $156B of “other long-term borrowings” at face value, not $39.1B reported fair value.

| Copyright © 2008-2009 by John G. Appel. All rights reserved. You may link to any Content on this website. You may not republish, upload, post, transmit or distribute any Content without prior written permission. If you are interested in reprinting, republishing or distributing Content, please contact John Appel via the e-mail address shown on this website to obtain written consent. Modification of Content or use of Content for any purpose other than your own personal, noncommercial use is a violation of our copyright and other proprietary rights, and can subject you to legal liability. Disclaimer: This website is provided for informational purposes only. Nothing on this website is intended to provide personally tailored advice concerning the nature, potential, value or suitability of any particular security, portfolio or securities, transaction, investment strategy or other matter. You are solely responsible for any investment decisions that you make. Terms of Use: By using the site, you agree to abide by the Terms of Use, which includes further copyright information and disclaimers. |