XL Capital (XL) is a company that the market loves to hate. Its stock price has plummeted by 94% over the last twelve months, mainly over concerns about its investment portfolio. (For a more in-depth discussion of XL’s past troubles, please see my article from November 25th, “Reinsurer Stocks: A Fear-Driven Market Creates Opportunity.”) The stock could tick up a bit in connection with the unwinding of hedges related to forward share purchase contracts that settle on February 17th. The company’s fourth quarter earnings call on February 11th could also bring positive news that lifts share prices, perhaps accelerating the hedge unwinds, and potentially leading to further short covering.

|

Short interest in XL stock is the highest of all commercial lines insurance companies as a percentage of float, at 9.3%, according to a recent Credit Suisse report. One might be tempted to view this as a sign that many investors believe the stock is headed to zero soon. However, there is more to this story.

Most of these short sales are likely to be hedges rather than speculative plays. XL has entered into forward sale agreements on up to 47.4 million common shares. Much of the current short interest of 30.5 million shares is probably related to hedges of these agreements.

Equity Security Units

The forward purchase/sale agreements are part of $1.32 billion of outstanding “Equity Security Units” comprised of:

• $745 million of 7% Equity Security Units sold on December 9, 2005 (prospectus), and

• $575 million of 10.75% Equity Security Units sold on August 5, 2008 (prospectus).

Each unit consists of a portion of a note and a contract to purchase a like amount of common shares at a minimum price. The minimum price to be paid by holders of the 7% units is $65 per share. Quite a premium compared to today’s price of under $3 per share!

The Equity Security Units are a bit complicated, but essentially what happens is that on the “settlement date,” the unit holders are required to purchase shares of common stock at some price between the minimum price and a maximum threshold price. At the same time, the related notes are remarketed. That is, they are reoffered for sale at a new interest rate intended to bring the price (net of a small remarketing fee) back to par. If the notes are successfully remarketed, the unit holders use the proceeds of the remarketing to fulfill their common stock purchase obligations. If the notes are not successfully remarketed, XL can use the notes to fund the common stock purchases. Thus, from XL’s perspective, the worst case is that the units act like convertible debt that converts on the settlement date. The best case is that the notes remain outstanding after a successful remarketing, and the purchased common stock is incremental new capital.

Partial Hedge Unwind Coming

The settlement date for the 7% units is February 17, 2009. The unit holders will be required to purchase an aggregate of 11.46 million common shares for $65.00 per share, or $745 million in total. (XL hired Goldman Sachs to remarket the notes. To the extent they are successful, the common share purchase will constitute incremental capital. If Goldman is not successful, the notes will effectively “convert” into common at $65 per share – adding to common equity but not total capital.)

The chart below shows that less than half of the 7% units were hedged while the common stock was trading well above the minimum forward price. As the stock price broke through $65 per share, short interest grew, reaching about 12 million shares as the price passed through $40 per share. At that point, the 7% units were probably fully hedged. Short interest popped up by over 10 million shares, to approximately 25 million shares, when the 10.75% units were issued. Short interest approached its current level of 30.5 million shares last October, as the stock price fell below $10 per share.

If all $745 million of stock purchase obligations related to the 7% units are hedged with short sales, short interest should decline by at least 11.5 million shares near the contract settlement date of February 17th. The stock could see some upward pressure as these short sales are covered, although the impact would be small, as the covered shorts would represent just over 1x average daily trading volume.

Earnings Call

The impact from short covering could be eclipsed by reactions to the company’s fourth quarter earnings announcement on February 10th and analyst call on February 11th.

XL’s shares reached a low closing price of $2.68 last December after the company announced that mark-to-market and impairment losses on its investment portfolio as of December 10th would be consistent with amounts for the prior quarter, or approximately $1.1 billion, and, as a result (i) analysts cut prices targets significantly, and (ii) S&P, Moody’s, and Fitch cut XL’s ratings again.

The main reason for the negative action by sell-side analysts was concern that additional investment losses could lead to a need to raise dilutive capital. As for the ratings cuts, these actually seemed to be driven less by potential balance sheet issues (although these were cited, of course) than by a concern that the company’s financial problems could have damaged its reputation to the point that it could lose a meaningful amount of business at January 1 renewals and beyond, or that it would need to under-price business to retain it, or both.

After rising to $4.69 per share on January 9th, the stock has retested its $2.68 December low. At this price, which is only about 0.15x book value, the bad news is once again priced in. It would take a large negative surprise to drive shares down significantly, and anything short of disastrous news should send shares higher.

It does not seem likely that investment losses will exceed last December’s guidance. Market prices for many classes of securities held by XL – such as high-grade corporates and securities backed by subprime loans and commercial real estate loans – were higher at year-end than at the time XL provided guidance. Thus, investment losses might come in slightly better than expected. However, it is more likely that any benefits from lower rates and tighter spreads are offset by additional marks on other asset classes, such as investments in hedge funds.

It is difficult to predict XL’s Q4 revenue and operating profit, and to know how well XL fared in January renewals. However, there is no indication that XL’s business has fallen off substantially. According to Business Insurance (article), XL’s policyholders are not abandoning the company (although they are watching things carefully), and XL is being offered the opportunity to bid on new business. However, Business Insurance implied that D&O coverage could be one area where XL may be more vulnerable.

This is consistent with what other insurers have been saying on recent earnings calls. Some companies have mentioned that risk managers have not been as willing to move business as they had expected. However, ACE Ltd. (ACE) said that its D&O business has benefited from a significant “flight to quality.” It is not clear if this has come at the expense of AIG, XL or both.

So far, financial results announced by competitors have been mixed. However, 2009 guidance has been consistently positive. Pricing appears to be more rational overall, and has firmed slightly in most lines of business. Expectations are for further improvement throughout the year.

According to the company’s website, the median analyst estimate for Q4 EPS is $0.35 and the median estimate of book value per share is $21.65, about flat with the prior quarter. Bloomberg shows consensus estimates of $0.43 for adjusted EPS and $19.36 for BV/shr. The latter BV/shr figure is more consistent with management’s December guidance on investment losses. Book value could be reduced further by the impact of a stronger dollar.

On the February 11th call, management should be able to make a convincing argument that the franchise is still very much alive, and that profitable growth will be forthcoming in 2009. If the company surprises on the upside, positive movement in the stock could be enhanced by some short covering beyond the unwinding of hedges on the 7% Equity Security Units.

(Disclosure: the author is long XL, as well as ACE, AXS, PRE and VR)

| Copyright © 2008-2009 by John G. Appel. All rights reserved. You may link to any Content on this website. You may not republish, upload, post, transmit or distribute any Content without prior written permission. If you are interested in reprinting, republishing or distributing Content, please contact John Appel via the e-mail address shown on this website to obtain written consent. Modification of Content or use of Content for any purpose other than your own personal, noncommercial use is a violation of our copyright and other proprietary rights, and can subject you to legal liability. Disclaimer: This website is provided for informational purposes only. Nothing on this website is intended to provide personally tailored advice concerning the nature, potential, value or suitability of any particular security, portfolio or securities, transaction, investment strategy or other matter. You are solely responsible for any investment decisions that you make. Terms of Use: By using the site, you agree to abide by the Terms of Use, which includes further copyright information and disclaimers. |

This is frustrating, and begs the question of whether there is something else going on at Cott. Crescendo’s CEO, Eric Rosenfeld, joined Cott’s board as Lead Independent Director, and I doubt that he would sit idle while things drag on. Cott hired a respected search firm to help identify a CEO, and Crescendo also had at least one candidate lined up. It is possible that the board has not been able to agree on a candidate. It is also possible that they had a big fish on the line but that it got away at the last minute. However, it is also possible that the board slowed down the process to deal with something else. This is sheer speculation, but one reason to delay the process, and the only good reason I can think of, would be a potential sale of the company.

This is frustrating, and begs the question of whether there is something else going on at Cott. Crescendo’s CEO, Eric Rosenfeld, joined Cott’s board as Lead Independent Director, and I doubt that he would sit idle while things drag on. Cott hired a respected search firm to help identify a CEO, and Crescendo also had at least one candidate lined up. It is possible that the board has not been able to agree on a candidate. It is also possible that they had a big fish on the line but that it got away at the last minute. However, it is also possible that the board slowed down the process to deal with something else. This is sheer speculation, but one reason to delay the process, and the only good reason I can think of, would be a potential sale of the company.

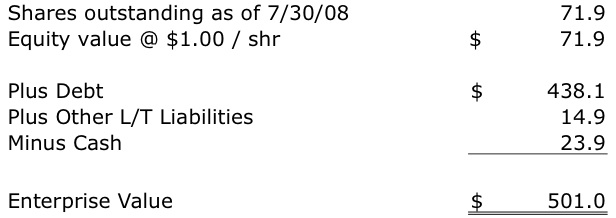

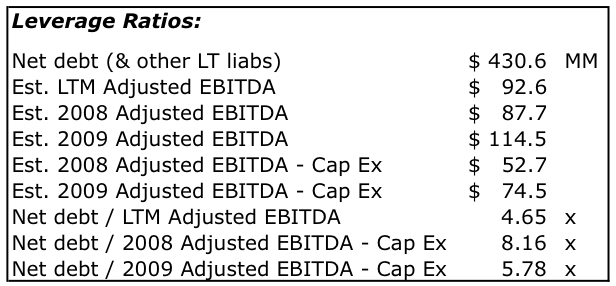

Cott’s high leverage means that it cannot afford to make a mistake. The chart to the right shows Cott’s net debt as of September 27th, and how this compares to various measures of cash flow.

Cott’s high leverage means that it cannot afford to make a mistake. The chart to the right shows Cott’s net debt as of September 27th, and how this compares to various measures of cash flow.

This is CIC Advantage’s second investment to date. The first was a $12 million growth capital investment in

This is CIC Advantage’s second investment to date. The first was a $12 million growth capital investment in