The market’s valuation of Jamba Inc. (JMBA) seems to reflect a consensus view that this chain of 729 smoothie stores will not survive. After a review of JMBA’s fourth quarter and full-year 2008 results, and several calls with management, I disagree. I predict that this company will not only survive but thrive.

The company still faces extremely weak retail sales traffic, and a consumer that is cutting back on discretionary, premium-priced items. However, the company’s new CEO, James White, has a good understanding of what it takes to succeed in this environment, and is quickly reorienting the company’s offerings to deliver what today’s consumer wants – healthy, convenient, fun food at an affordable price. His vision and passion, combined with intense focus and a sense of urgency, are exactly what the company needs right now.

In the analysis below, I discuss (click to skip to section):

- Current Valuation and Consensus View

- New CEO: Focused and Results-Oriented

- Strategy and Execution

- Risks and Opportunities

- Financial Projections

- Potential Future Valuation and Catalysts

Current Valuation & Consensus View

A recent share price of $0.47 implies an enterprise value (equity + debt – unrestricted cash) of $25 million – approximately 0.6x store-level EBITDA and about 3.3x adjusted EBITDA, based on my 2009 forecast. For comparison, PEET trades at about 7.9x EBITDA, and SBUX trades at approximately 7.6x EBITDA. QSR concepts SONC and JACK trade at about 6.7x EBITDA.

A recent share price of $0.47 implies an enterprise value (equity + debt – unrestricted cash) of $25 million – approximately 0.6x store-level EBITDA and about 3.3x adjusted EBITDA, based on my 2009 forecast. For comparison, PEET trades at about 7.9x EBITDA, and SBUX trades at approximately 7.6x EBITDA. QSR concepts SONC and JACK trade at about 6.7x EBITDA.

The common viewpoint seems to be that: (a) JMBA’s business model is not viable, and (b) the company will run out of money before management has time to figure things out.

In 2006 and 2007, the business model was indeed broken outside of California, and deteriorating in California. A smoothie may provide a boost of energy, but it is not a cup of coffee. Coffee drinking is a habit, often repeated several times a day. Even regular smoothie drinkers are unlikely to average one per day, let alone several. Yet prior management acted as if a smoothie could replace coffee and JMBA could be the next Starbucks. They opened stores too close to each other, and in suboptimal locations. New stores outside of California had AUVs well under $600,000 and even CA store AUVs were dropping (especially for stores not included in comp store figures at the time), but JMBA’s cost structure, at both the store level and at corporate, was geared toward a system with $800,000 to $1 million AUVs. Cash flow margins for stores outside of CA were in the single digits. California store margins were still over 20% for seasoned stores, but newer store margins were only in the teens. New stores in general were not even getting close to management’s target of 20% store-level EBITDA and 40% cash-on-cash returns. Meanwhile, comp stores in 2006 and 2007 were flat.

This broken business model and a flawed growth strategy – along with the purchase of stores from franchisees – caused JMBA to blow through its $100 million in post-IPO cash reserves and get in trouble, or at least too close for comfort, with its banks. This forced the company into an extremely costly debt financing – with $25 million coming due in less than 18 months.

Looking back over the last year, what we see is a company that:

- Is suffering double-digit declines in comp store sales because it sells the sort of expensive indulgence on which consumers are cutting back;

- Has not been able to articulate a strategy to fix the store-level business model;

- Cannot afford to build new stores;

- Might not have a profitable enough business model to attract new franchisees; and

- Has less unrestricted cash on hand than necessary to repay its debt, and no proven ability to generate cash from operations.

Yes; this is pretty scary stuff. However, over the last several months, the company has reduced its costs, store labor and SG&A in particular, and closed a number of underperforming stores. Under James White, who joined JMBA last November, the company has developed a more focused strategic plan, and will further reduce costs while growing its product offering and franchise system. The combination of a store model that now works better at lower AUVs, and an increase in AUVs through menu expansion, should be effective. The picture looking ahead shows promise.

New CEO: Focused and Results-Oriented

JMBA’s new CEO, James White, is an experienced brand builder, product developer, and foodservice operator. He came from Safeway, where he ran an $8 billion retail brand P&L, which included responsibility for brand strategy, R&D, product development, and manufacturing (prior experience includes Gillette, Purina and Minute Maid). He built the “O Organics” line of products for Safeway, through which he developed an extensive rolodex of organic food contract manufacturers. The line was so successful that Safeway began offering it to other grocery retailers last fall. He also knows multi-unit foodservice. Safeway’s in-store foodservice business – essentially a restaurant chain within a grocery store chain – is bigger than Quiznos.

He sees that the brand equity of Jamba Juice is more in the “Jamba” than the “Juice” and that Jamba can grow to be a leading healthy lifestyle brand with broad application and appeal. But he is not letting these big ideas distract him from the necessary task of creating the maximum positive impact in the least amount of time. To this end, he has the team focused mainly on four key initiatives: retail food, franchising, wholesale food/licensing, and local store marketing.

Strategy and Execution

Retail Food – JMBA wants to build a retail food capability across all four day parts (breakfast, lunch, afternoon, and dinner). Oatmeal has exceeded management’s expectations. In the coming months, the company will begin rolling out items for other day parts, likely focusing on high-traffic metro area stores where oatmeal has had the greatest uptake. The company is focused on food items that, like its smoothies and now its oatmeal, are superior to the offerings of competitors, have high margins, are relatively simple to execute in the stores, and are consistent with the Jamba brand’s promise of great tasting, healthy, convenient, fun, on-the-go foods.

I estimate that breakfast and lunch could add $45,000 to $75,000 of annual sales per store ($30-50k of food sales plus an additional $15-25k of blended drink sales from the incremental customer base). Since food will probably not work equally well in all locations, I would assume that perhaps 75% of stores benefit. Thus, the overall impact on company-wide same-store sales would be in the range of 6-9%. I expect minimal impact in the first half of 2009, and very little impact until 2010.

Franchising – JMBA has halted new company-owned store development for now, focusing its current efforts on improving the performance of its existing stores and growing its franchise system. As of December 31, 2008, 511 stores (70%) were company-owned and 218 (30%) were franchisee-owned. The company is now targeting something closer to a 50/50 mix. As part of this effort, JMBA is seeking to “refranchise,” or sell back, certain stores to franchisees (so far, ~30 stores have been identified for refranchising, of which the first 10 were sold this month). For new franchised locations, JMBA is increasing its focus on “non-traditional” locations such as airports, which have been very successful to date. This shift to a more balanced company-owned/franchised mix will help preserve capital, and lead to higher overall profit margins.

I made some rough estimates of the economics of a new store for each of three types of locations: suburban strip centers, urban metro areas, and airports. The figures show that the economics of airport locations probably work very well today, which explains why JMBA is focusing on these now. The suburban and urban metro “traditional” stores are probably adequate for an existing franchisee who can share some labor among stores, but probably fall slightly short of the return required to attract significant numbers of new franchisees. With food, these locations should provide sufficient returns for a robust franchising model (once franchise capital is generally available again).

Wholesale Food/Licensing – White wants to capitalize on one of the things prior management did well: build a strong brand. JMBA has now hired a senior executive, Susan Shields, to lead a branded CPG effort. It is focused on licensing, but could include products that are contract manufactured for, and sold by, JMBA or through a JV. The company has had discussions with potential partners regarding fruit teas, fruit yogurt and parfaits, frozen smoothie bars and sorbets, breakfast and energy bars and packaged boosts.

A successful offering in any one of these packaged food categories could be a $50-$100+ million business, so it is conceivable that a wholesale food effort could deliver $3-5 million per year, or more, of incremental cash flow. Also, while Nestlé has shelved the licensed RTD smoothie line launched last year, JMBA’s 2008 10-K states, “We believe Nestlé is fully committed to re-launching a Jamba ready-to-drink beverage proposition.”

Local Store Marketing – The company believes that it can reduce spending on traditional advertising and marketing, and more efficiently build store traffic by focusing on “owning the two-mile radius” around each of its stores. This effort includes off-premise sales such as at schools, and community and sporting events. It also includes store-level sales incentives, and a greater emphasis on working with non-profit groups for fundraising.

In the short term, this will probably only serve to reduce the decline in same-store sales. Assuming that retail sales are only just now beginning to bottom-out, without a food program and any enhanced efforts to drive traffic, same-store sales would be negative at least through year-end. A successful local marketing program should mitigate the decline this year and help drive positive comps next year.

This seems like a lot for a small company to accomplish at once, but according to management, the team is actually focused on doing fewer things, but doing them better, and with a stronger sense of responsibility and accountability. For example, in the past, development of new food items and licensing opportunities were projects added to somebody’s “normal” work schedule. Now these initiatives are being driven by people who’s jobs are at stake if these initiatives are not successful. My sense is that this greater focus and accountability has created a sense of urgency, and a level of positive energy at the “support center” (i.e., corporate office), that has not existed in years.

Risks and Opportunities

A lot could still go wrong, and, as shown in my financial projections, management does not have a lot of cushion. Some of the many risks to a turnaround include:

- Higher unemployment rates expected this year could potentially drive overall retail sales and consumer spending significantly lower.

- The roll-out of lunch items into certain retail stores, which should kick off this spring, might not go smoothly. Management is making decisions quickly and will recalibrate in the field if/as necessary.

- Competitors could respond to the food launch with enhanced promotions and other tactics.

- Costs for fruits, juice concentrates, dairy and other food ingredients are volatile and could spike up due to demand or supply shocks.

- Weather could have a negative impact on sales and food costs.

- Gas prices could have a negative impact on sales and food costs.

Of course, there are many other risks, from food-borne illnesses to increased labor and benefits costs. One can pick up the latest 10-K for the usual laundry list.

However, I believe that with its new leadership, this team can navigate through the current economic environment and execute a successful turnaround. The current store-level business model works better than one might think, and the strategic shift from a smoothie chain to healthy lifestyle brand will add to both sales and profits. At a minimum, things should get better. If management delivers completely on both the tactical turnaround and the strategic changes, the growth will be dramatic: The strategic shift will not only add to the sales and profits of existing stores, but also (a) substantially increase the number of potential retail sites, and (b) create significant interest in the franchise community.

Financial Projections

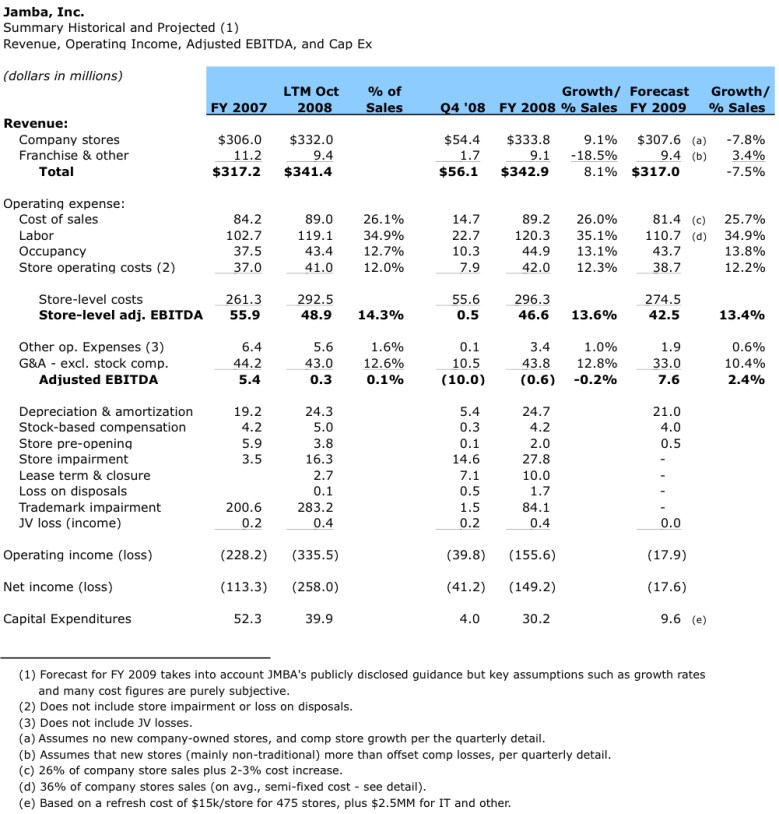

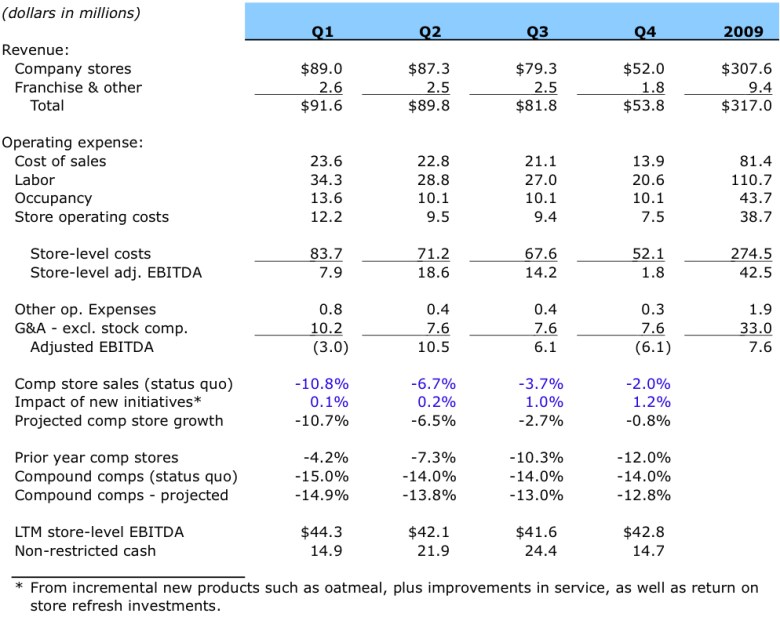

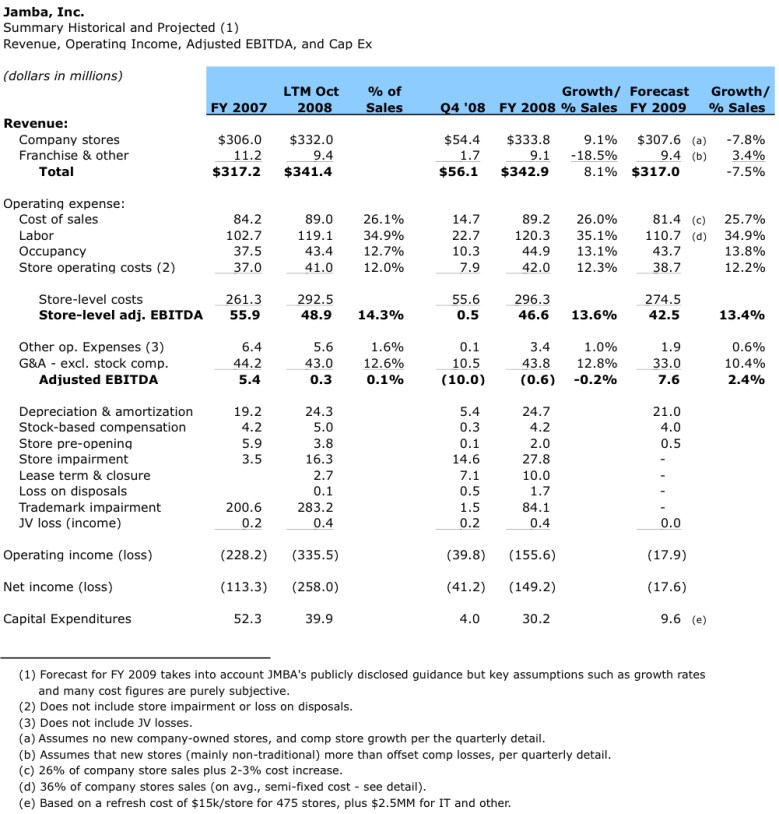

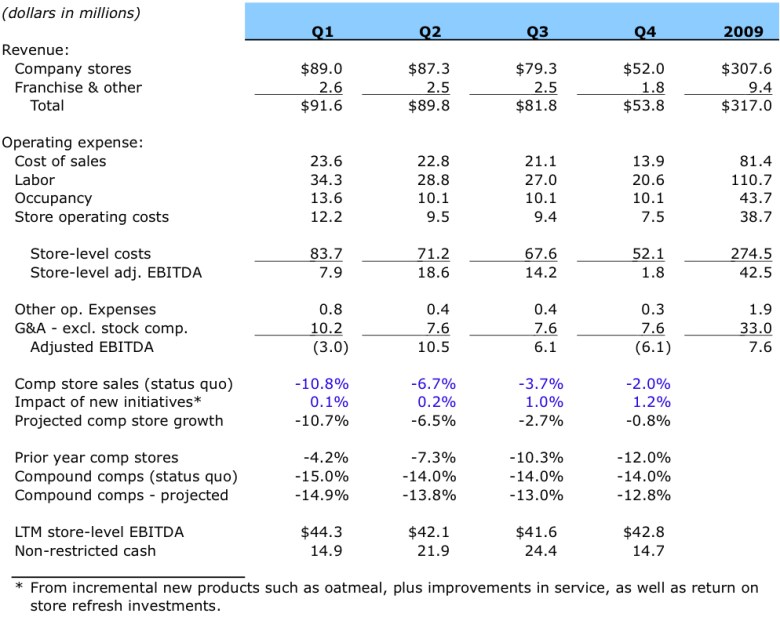

Below is a summary of the company’s financial performance in 2007 and 2008, as well as a forecast for 2009. In the first table, I show annual sales dropping 7.5% to $317 million in 2009. I assume that food costs average 26.5% of sales versus management’s target of 26%, and labor costs average 36% of sales versus a target of 34%. The second table shows the 2009 quarterly forecast, and assumptions for same-store sales. It also shows the resulting trailing 12-month store-level EBITDA and projected unrestricted cash levels.

Same-store sales are modeled assuming two-year cumulative comps, before any impact of new food items and other initiatives, down 15% in Q1’09, and down 14% for the rest of the year. The new retail food initiative is assumed to add just slightly to comp stores later in ’09. No sales are included for wholesale/licensed food. Store growth assumes no new company-owned stores and 50 new franchised locations, per management’s guidance. The pro forma impact of refranchising 10 Arizona stores is included, but no additional store sales are included. There is no specific impact for local store marketing, although one could assume this is reflected in the 1-point improvement in compound comps after Q1’09.

These projections show JMBA with a seasonal loss in Q1 but significant positive cash flow in Q2 and Q3 this year. Store-level EBITDA remains comfortably above the $35 million covenant level. Unrestricted cash rises to roughly the amount of the company’s outstanding debt in Q3 of this year, then falls to $14.7 million in Q4 after seasonal losses. Even if comps are roughly 5% down in 2010, the company should still generate enough additional cash to repay the debt when it comes due in September 2010 (although it would be tight). Successful implementation of the company’s current growth initiatives should provide substantial upside beyond this scenario.

Quarterly projections are shown below:

Potential Future Valuation and Catalysts

It will be hard to get excited about Q1 results, but a performance in Q2 like that projected above should demonstrate that the company is on the road to recovery. This could be a catalyst for a significant improvement in the company’s valuation. Growth in enterprise value to 1.2x ’09 projected store-level EBITDA, or 6.7x ’09 projected EBITDA, would bring the equity market cap to $55 million, or $0.95 per share. This is my six-month price target. My 12-month target is $1.30 per share (unchanged from December).

Short covering could accelerate this adjustment. At current prices, there is very little volume. With short interest of 2.3 million shares as of 3/31/09, “days to cover” was over 31 (see chart here).

An increase in market cap could create an virtuous upward cycle. Currently, investors who want to own less than 5% of the company are capped at an investment of just over $1 million, which is just not meaningful for many institutional investors. As JMBA’s valuation improves, the stock will become more relevant.

Another potential catalyst would be coverage by a major sell-side analyst. Recent investments in JMBA by PE group CIC Advantage and value fund manager Royce & Associates may help renew interest in the analyst community. A restaurant industry analyst from Piper Jaffray was on the last earnings call. I would not be surprised to see them pick up coverage again once the company demonstrates more progress on its turnaround.

(Disclosure: The author is long JMBA)

| Copyright © 2009 by John G. Appel. All rights reserved. You may link to any Content on this website. You may not republish, upload, post, transmit or distribute any Content without prior written permission. If you are interested in reprinting, republishing or distributing Content, please contact John Appel via the e-mail address shown on this website to obtain written consent. Modification of Content or use of Content for any purpose other than your own personal, noncommercial use is a violation of our copyright and other proprietary rights, and can subject you to legal liability. Disclaimer: This website is provided for informational purposes only. Nothing on this website is intended to provide personally tailored advice concerning the nature, potential, value or suitability of any particular security, portfolio or securities, transaction, investment strategy or other matter. You are solely responsible for any investment decisions that you make. Terms of Use: By using the site, you agree to abide by the Terms of Use, which includes further copyright information and disclaimers. |

JDA Software Group, Inc. (

JDA Software Group, Inc. (

A recent share price of $0.47 implies an enterprise value (equity + debt – unrestricted cash) of $25 million – approximately 0.6x store-level EBITDA and about 3.3x adjusted EBITDA, based on my 2009 forecast. For comparison, PEET trades at about 7.9x EBITDA, and SBUX trades at approximately 7.6x EBITDA. QSR concepts SONC and JACK trade at about 6.7x EBITDA.

A recent share price of $0.47 implies an enterprise value (equity + debt – unrestricted cash) of $25 million – approximately 0.6x store-level EBITDA and about 3.3x adjusted EBITDA, based on my 2009 forecast. For comparison, PEET trades at about 7.9x EBITDA, and SBUX trades at approximately 7.6x EBITDA. QSR concepts SONC and JACK trade at about 6.7x EBITDA.

This is frustrating, and begs the question of whether there is something else going on at Cott. Crescendo’s CEO, Eric Rosenfeld, joined Cott’s board as Lead Independent Director, and I doubt that he would sit idle while things drag on. Cott hired a respected search firm to help identify a CEO, and Crescendo also had at least one candidate lined up. It is possible that the board has not been able to agree on a candidate. It is also possible that they had a big fish on the line but that it got away at the last minute. However, it is also possible that the board slowed down the process to deal with something else. This is sheer speculation, but one reason to delay the process, and the only good reason I can think of, would be a potential sale of the company.

This is frustrating, and begs the question of whether there is something else going on at Cott. Crescendo’s CEO, Eric Rosenfeld, joined Cott’s board as Lead Independent Director, and I doubt that he would sit idle while things drag on. Cott hired a respected search firm to help identify a CEO, and Crescendo also had at least one candidate lined up. It is possible that the board has not been able to agree on a candidate. It is also possible that they had a big fish on the line but that it got away at the last minute. However, it is also possible that the board slowed down the process to deal with something else. This is sheer speculation, but one reason to delay the process, and the only good reason I can think of, would be a potential sale of the company.

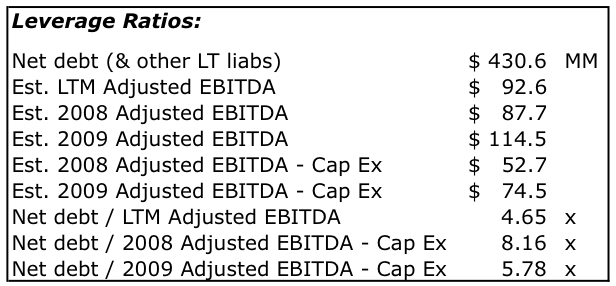

Cott’s high leverage means that it cannot afford to make a mistake. The chart to the right shows Cott’s net debt as of September 27th, and how this compares to various measures of cash flow.

Cott’s high leverage means that it cannot afford to make a mistake. The chart to the right shows Cott’s net debt as of September 27th, and how this compares to various measures of cash flow.

This is CIC Advantage’s second investment to date. The first was a $12 million growth capital investment in

This is CIC Advantage’s second investment to date. The first was a $12 million growth capital investment in